US voters were given a real-time civics lesson last week as all three branches of government came into play. A majority of the Supreme Court ruled that the President overstepped his authority by using a 1977 emergency law (IEEPA) to impose tariffs without Congressional approval, reaffirming the limits of executive power.

“Tariff” may still be the President’s favorite word, but it is unlikely to resonate with those now asking for refunds on the roughly US$175 billion already paid under the policy.

In the Weekly Market Digest, despite the deluge of economic and geopolitical news, the US markets had a positive week. Although the week began with the US GDP growth missing expectations and the PCE rising above forecast, the end of the week focused on tariffs after SCOTUS struck down the US administration’s tariff strategy, which then called for blanket tariffs to make up the difference.

In addition, the US administration continues to threaten ‘limited’ military strikes on Iran, which has supported a lift in oil prices and precious metals, and the benchmark equity ETFs, despite a stronger US dollar.

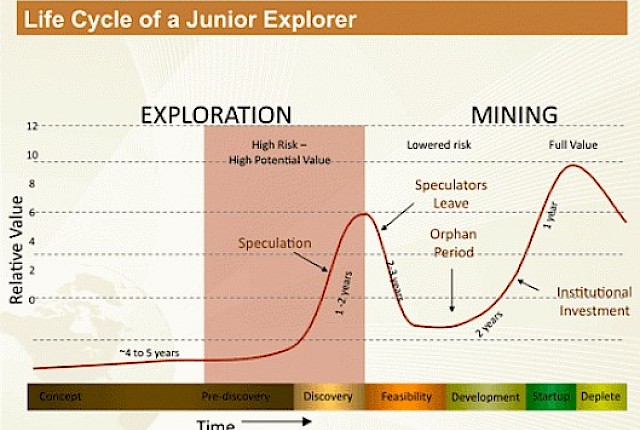

The Exploration Insights Portfolio was up last week, led by a grassroots copper explorer in Australia, a Top Pick copper explorer in the Yukon, and a former Top Pick precious metal developer in NW Argentina, which offset the underperformance of a Quebec-focused prospect generator.

In Stock Talk, I focus on my site visit to Michigan to visit the newly acquired assets of a critical mineral producer. I also review the acquisition of land by a precious metal developer to secure expansion possibilities and the termination of an option by a copper developer in Arizona.