My extended trip to eastern Canada last week included co-leading a short course at PDAC, speaking at the Metals Investor Forum (MIF), the Investment Leaders Forum, and Peru Day, and completing a two-day site visit to a revamped copper-gold project in Newfoundland.

My extended trip to eastern Canada last week included co-leading a short course at PDAC, speaking at the Metals Investor Forum (MIF), the Investment Leaders Forum, and Peru Day, and completing a two-day site visit to a revamped copper-gold project in Newfoundland.

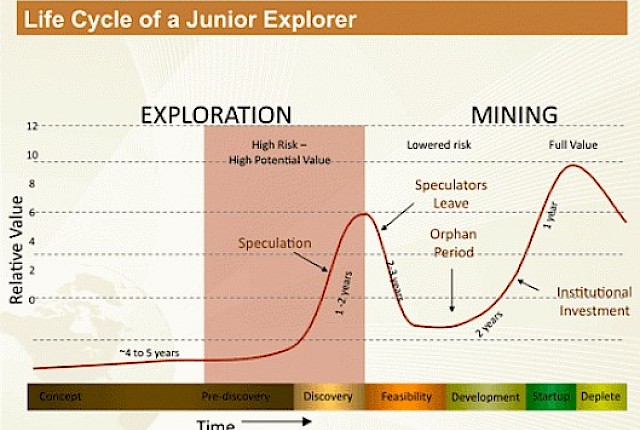

The initial buoyant mood at PDAC, when some attendees seemed ready to bring any available core to the core shack, faded as market volatility spiked. By the end of the event, attention had shifted to rising energy prices and a weaker-than-anticipated US jobs report, cooling some of the early optimism held among investors.

In the Weekly Market Digest, I break down market activities over the past fortnight. The week before PDAC was much more positive for metals and mining than last week due to the negative impact of the US and Israel attack on Iran on the energy sector.

The Exploration Insights Portfolio was up during the first week but down in the second, yet it outperformed the benchmarks. I adjusted some Top Picks following an M&A transaction.

The Rant draws on insights from the recent industry conference circuit, with a contribution by Kitco Mining’s Paul Harris, highlighting renewed investor interest in mining, stronger balance sheets, and rising financings and M&A activity, while also noting persistent challenges that higher commodity prices may not fix anytime soon.

In Stock Talk, a Top Pick US-based copper developer catches a bid from an intermediate copper producer. As a result, I will recognize a gain from a partial sale while retaining an interest in the copper exposure from the producer. I also cover the approval of a major government investment program for a gold-silver project in NW Argentina.

I plan on diving into the plethora of news from companies attending the various conferences in the next letter.